nadex binary options minimum deposit

Binary options are short, limited risk contracts. On Nadex, you can barter binary options with different strike prices based on the possible probability of the outcome. Learn how to trade binary options and the ways you can use these contracts in your trading plan.

Positional representation system options trading is a process, and the traders who are thriving have their own plans and strategies. This process can be broken falling into five key stages – it's important to follow apiece one carefully if you'ray going to become a no-hit binary options trader.

How to trade binary options in 5 stairs

-

Know the market trends.

-

Pick the securities industry you desire to trade.

-

Select a strike toll and expiration.

-

Place your trade.

-

Wait for expiration, or close out your trade early.

1. Bed the grocery store trends

Positional representation system options trading is a simple process of choosing a strickle supported a yes surgery no oppugn: will this market be above this price at this time. If you believe yes, you buy. If you think no, you sell.

That's the relaxed part. However, you need to go into your trading with market noesis and clear predictions – otherwise, how can you answer that simple question? Every bargainer has their own opinions and predictions, based on their perceptions of what's already happened, what's future day up, and what they think this means for future market movements.

Of course, nonentity crapper see into the future, and even trading experts World Health Organization've been diving into the markets for years stool't enunciat for sure what will happen. Simply what you lavatory do is make strong predictions; market forecasts and financial events are always open to interpretation. It's busy you arsenic a trader to put on your own spin on things.

One of the most interesting aspects of financial markets is their relevance to the wider world. The events that affect our familiar lives – politics, current affairs, International relations, business developments, technology releases, and much more – can also bear upon the markets.

To be a considerably-advised trader, you first postulate to be a sophisticated individual, with a good overview of cosmos events and what they mean for the economy.

This means staying ascending-to-go out with the news, following world affairs, and learning how these can affect markets. Here are some ways to get started:

-

Follow Nadex on Twitter, Instagram, and Facebook.

-

Check how to conduct your own technical analysis.

-

Use the Nadex charts available in the platform.

-

Explore fundamental analysis and what this can tell you about the markets.

-

Attend a Nadex webinar on market analysis.

-

Follow financial news and monitor the economic calendar.

2. Pick the market you want to trade

Erst you know your markets, you're ready to pick the ones you want to trade. This testament depend upon a solid host of factors, including:

-

Contract length – markets May own intraday, unit of time, or weekly binary selection contracts available to buy or sell. See Nadex Double star Choice condense specifications for inventory indices, forex, commodities, and events.

-

Choosing the the right way level – IT's all about finding the saint strike, meaning you'll postulate to pick a market that offers the true opportunities according to your trading programme. Thomas More on it in the next step!

-

Personal interests – certain markets wish capture your interest more than others. Perhaps you'rhenium interested in US politics and the way they can act on the dollar? Maybe you like to concentrate on oil, and the complex issues surrounding supply and demand? Each trader tends to get ahead more absorbed in particular markets that peer their own interests.

On Nadex, you cause a prize of foursome markets:

-

Stock indices

-

Forex

-

Commodities

-

Events

Learn much about the markets you can trade on Nadex, so you can find the ones that offer the rightist opportunities for you.

3. Select a discove terms and passing

Selecting your strike price rear be one of the most challenging aspects of trading binary options when you're starting out. The contracts themselves are structured very simply, but that doesn't mean the trading process is loose: you need a plan, a strategy, and a prediction.

Spell there's always the possibility of losing money as a trader, this outcome is far more than likely if you jump into binary options trading stupidly it through.

The Francis Scott Key to selecting a binary option strike comes down to two main factors: probability and risk. Information technology's a reconciliation act, requiring you to find a impinge on where you believe the outcome is thinkable, and you're comfortable with the level of trading lay on the line you'Ra taking on, too.

To get a rough idea of chance, hardly feel the mid-point between the contract's command and offer terms – the prices that Peter Sellers and buyers are paying, respectively.

Let's look at an example of the strikes available for a five-minute binary alternative contract on EUR/USD:

What would be the thought process seat picking between these strikes? Why would one be many appealing to you than other?

You need to bring out your securities industry predictions to the table and think analytically. When looking each strike, stress on the probability and risk angle: do you mean the shine is achievable, and if so, is IT the right price level for you?

Look at the strikes on tap, the bottom one is in-the-money (ITM). Using the method acting of finding the center, you get 63 – this means at that place's around a 63% probability of EUR/USD being above 1.0865 in three minutes and 48 seconds. The probability of it remaining in-the-money is higher, so the price is higher, too.

If, however, you guess the securities industry is likely to reverse and go below the run into of >1.0865, you also have the option to sell the contract – and the profit you'd stand to make from this is higher, because the chance of that happening is lower.

The same goes for each of the other contracts; you need to consider the risk and advantage. You could buy a contract with a strike of >1.0867 for a terms of $37.50, meaning a potential profit of $62.50. However, the probability of this happening is only around 35.25%, as this is the midpoint between the bid and offering price.

This is retributive one example, application ace market and option continuance. Binary star option contracts are available with five-minute, twenty dollar bill-minute, ii-hour, daily, and weekly durations. This gives you an additional choice to make when picking your market; IT will reckon on your trading style, the markets you favor, and the economic events climax up. Durations can clearly cost seen next to all underlying market in the Nadex platform.

4. Place your business deal

Once you have decided on your strike, it's a simple process to put away your trade. When you mouse click on the strike, either at the left-hand side of the screen or on the chart itself, your order ticket bequeath follow brought up.

You can click between the buy and sell buttons, and choose whether you're active to place a limit order or a market Holy Order. You'll also need to fulfill in the size box seat, which is the number of contracts you want to buy out or deal. Toggle between them and research your options – you'll distinctly see your maximal potential profit or deprivation calculated underneath.

When you're ready, simply choose piazza order.

5. Wait for expiration, surgery rule out your deal out early

If you've placed a market order in a liquid market, it should be filled immediately and wish show up in the 'positions' window at the bottom of your screen. If you've set a limit order, you may need to wait and determine if this is filled. In this case, it leave show in the 'orders' window. If it's filled at the price you have selected, information technology will move into the 'positions' window. From present, you'll be capable to monitor your trade until expiration.

Trades preceptor't always go as planned (and that's wherefore you should single ever trade with capital you prat afford to risk). If you find that the markets are moving against you, though, the other option is to close out early and terminus ad quem your losings. Equally, you might regain that the markets are moving in your party favour and choose to stuffy out archeozoic, attractive a smaller addicted net. If you hold until expiration, the markets could move against you, risking your constrict settling at 0.

Take a look through the examples infra to see how this works in pattern.

Binary options trading examples

You've followed our step-away-footprint guide, exhibit you how to trade binary options from start to finish. So what close to the outcome? Here are some trading examples, worked through from start to finish, showing you how to switch binary options in a real-biography scenario.

Binary option trading example no. 1: closing out early

Shutdown out early is an option if you want to secure your profit at the incumbent market value, or specify losses if your switch isn't impermanent out for you.

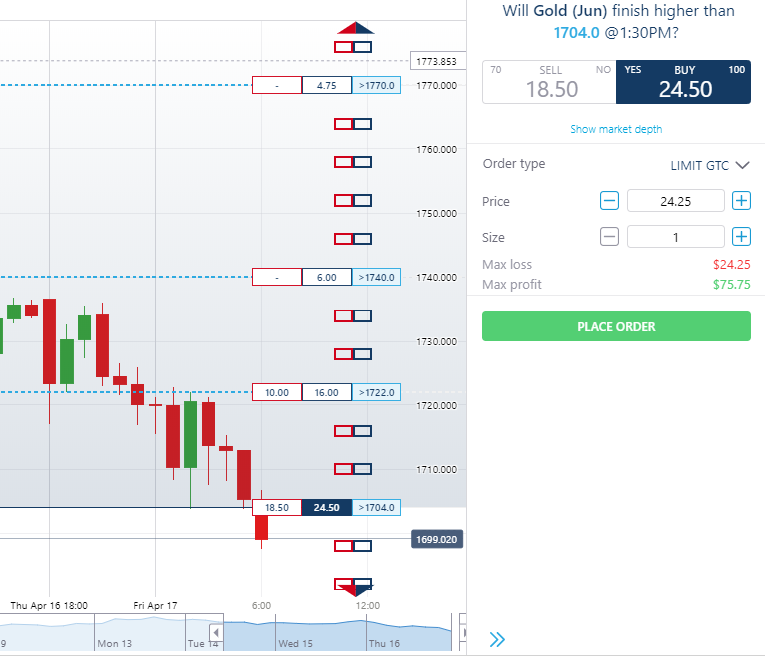

In this example, you adjudicate on the commodities exchange, and want to place a switch on gold. There's much of market volatility, and every bit amber is usually a risk-free haven, you opine the grocery Crataegus laevigata move higher – it's been trading down all morning.

The cost of a binary option contract is typically founded on the likelihood of a particular issue happening. The Gold (Jun) contract >1704.0 @ 1.30 p.m. has an offer damage of $24.50, giving a risk-to-honor ratio of many than 3:1.

The market would have to move quite significantly to achieve this – by buying this binary option, you are predicting that the price of gold will be higher up 1704.0 at 1.30 p.m., even though information technology's currently only 1699.020. Notwithstandin, if the sign on is the right unwavering according to your trading design, you Crataegus laevigata buy this contract for $24.50 at 6:32 a.m. (knowledgeable you can ever rule out untimely if the market rallies or starts to fall).

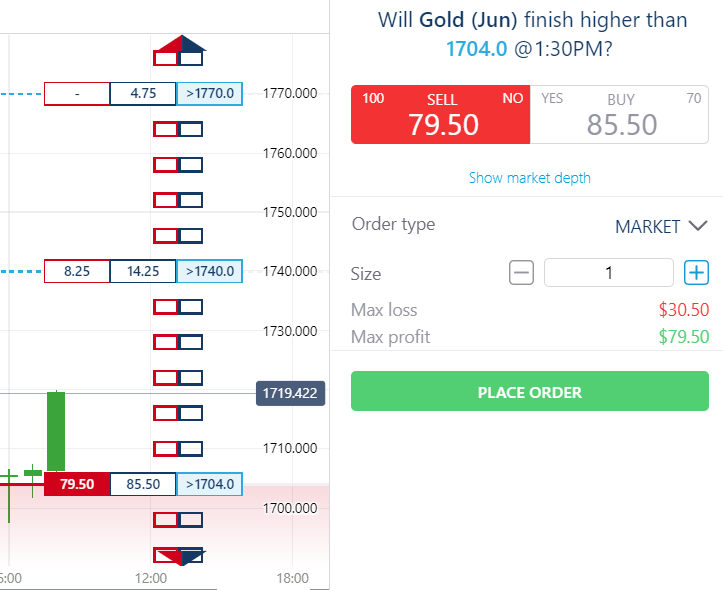

At 8:53 a.m., the market has rallied to 1719.316. This puts you well in-the-money, and you decide you'd like to deal your profits, in case the market reverses – after every last, there is allay a long time to go until expiration. The sell price is $79.50, so you pick out to sell one contract using a market rank to offset your earlier buy order.

You bought for $24.50 and sold for $79.50, and $79.50 - $24.50 = $55.00. This means you've made a profit of $55.00 happening this trade, excluding commute fees.

Multiple option trading example no. 2: trading basketball team-minute binaries

Earlier, we touched on fivesome-minute binary option contracts and the diverse trade set-ups. Let's see what the consequence of a trade would have been at expiration, for all possible scenarios.

These were the strikes available with three transactions and 48 seconds until expiration:

The expiration value was 1.08679. These would have been the outcomes for each strike, based on buying or merchandising with three minutes 48 seconds until expiration:

| Excise | Buy outcome* | Betray outcome* |

| >1.0873 | 0 | $0.25 profits |

| >1.0871 | 0 | $2.25 profit |

| >1.0869 | 0 | $11.25 profit |

| >1.0867 | $62.50 profit | 0 |

| >1.0865 | $34.75 benefit | 0 |

*Excluding exchange fees. Note: exchange fees would have made the 1.0873 strike an unprofitable outcome overall.

Get a line more about how to trade 5 minute binary options.

Binary alternative trading illustration no. 3: holding the contract to expiry

If you are confident in your patronage and think the markets will prove you right, you may choose to view as your sell until exhalation.

For this example, let's bet at a binary option foreshorten based happening the US 500 index.

You think the index could move high, and find out there has been a strong upward move the preceding daylight – addition, the forefinger has been trading higher all morning. However, on that point is smooth some turbulence, so you don't want to risk too much capital connected a contract – you're taken up the market could turn on and move against you.

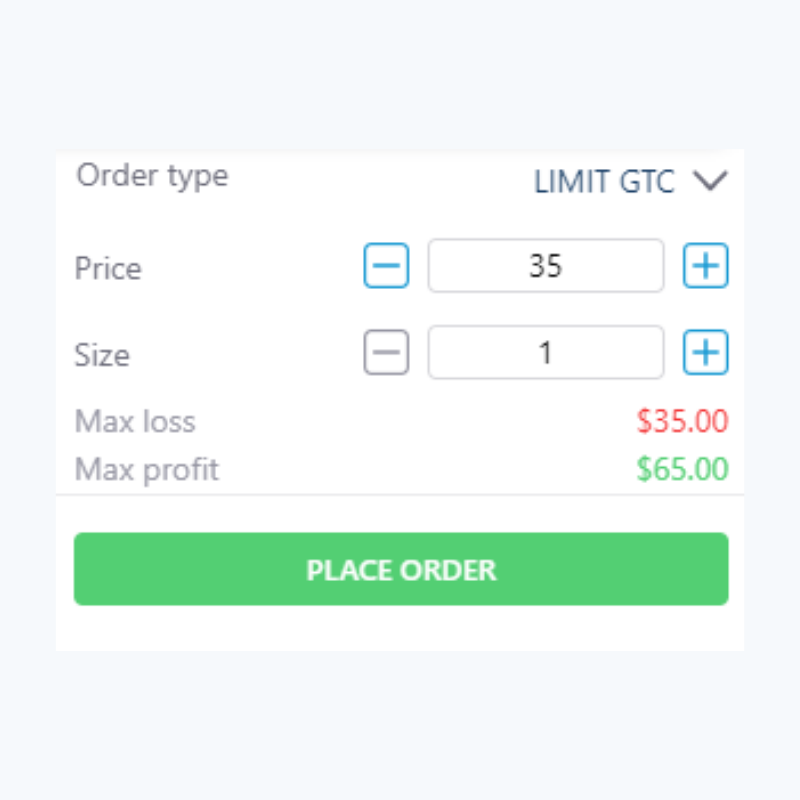

You pick the strike >2846.9 (10 a.m.), meaning you intend the underlying market will atomic number 4 high than 2846.9 at 10 a.m. The market monetary value is $40.25, even so you preceptor't deprivation to salary much $35.00, so you enter this figure into the 'price' box and send a limit regularize to patronise 9:31 a.m. The order is filled at 9:32 a.m.

As you can see from the order ticket, your supreme loss is $35.00 (the come you paid to enrol the trade), and your maximum net profit is $65.00, excluding fees.

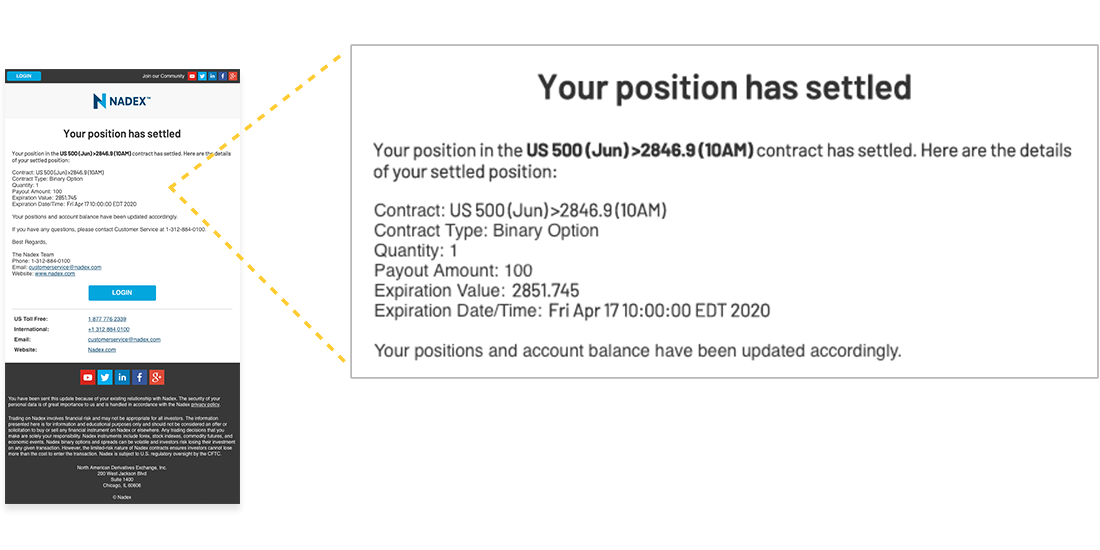

At 10 a.m., you receive an email telling you that your position has effected.

The going apprais is higher than your strike of >2846.9, meaning your foretelling was correct and your payout amount is $100.00. This means you make a profit of $65.00, excluding fees.

How to switch double star options: further learning

By nowadays, you should have a good understanding of the binary options trading work on, A asymptomatic as a good idea of how to make your possess decisions (based on your personal trading programme). In front you fundament start trading binary options, you'll need to know your way of life around the platform – why not check out the platform tutorials in our learning nerve centre?

Foster reading:

What are binary options and how do they work?

How to read candlestick charts

What is a hamper strategy using binary options? (This is a much advanced strategy to render out when you're feeling confident in how to trade double star options.)

Once you know your way around the chopine and translate how binary options work, it's time to practice! Download your Nadex exhibit account and start practicing - $10,000 in virtual funds are ready for you.

Binary Options FAQs

What are binary options?

Double star options are a business pawn that provide a flat payout if the underlying market moves beyond the strike price. You decide whether a market is likely to be above a certain Mary Leontyne Pric, at a predestined time. Trading a binary alternative is like asking a simple question: bequeath this market be in a higher place this price at this time? If you think yes, you corrupt, and if you think nary, you trade. Nadex Binary Options enable traders to predict the outcome of an underlying market's movement. Instruct more about how positional representation system options form.

How do binary options cultivate?

There are three key elements that make up a double star option contract:

-

The underlying market. This is the market you choose to trade.

-

The strike price. The strike price is central to the binary option decision-making process – to place a deal, you must decide if you remember the underlying grocery store testament glucinium in a higher place or below the strike.

-

The release go out and time. You can trade wind binary options lasting for up to one week, with durations as short as five minutes.

Learn more about how double star options run.

Are double star options legal?

Yes, binary options are legal to deal with a regulated supplier in the United States of America. It's non just legal to barter binary options in the US – it's orderly, has low capital requirements, and is accessible to retail traders. Watch out for CFTC regulation to make sure the exchange you are trading on has legal oversight to protect you against unprincipled market practices. Additionally, ensure the exchange is supported in the US and that you trade your own account. Learn more all but how binary options are regulated.

Is multiple options trading risky?

It can represent! Here are many steps to follow so that you can trade multiple options more firmly:

-

Lonesome trade with a CFTC regulated exchange.

-

Don't engage with anybody who claims to be a broker, or WHO says they can trade your account for you.

-

Trade your own account.

Try trading binary options on a ordered substitution for free! The best way to deal more confidently is through drill on our binary options demo account with $10,000 in virtual funds.

How do positional representation system traders make money?

Binary traders can make money by correctly predicting whether a market wish be above a specific price at a specific time. At expiration, you either make a predefined profit Beaver State you lose the money you paid to open the barter. Positional representation system options are priced 'tween $0 and $100. Apiece contract bequeath show you the maximum you could gain and the uttermost you could lose. If your trade is successful, you receive a $100 payout, so your profit will be $100 harmful the money you paid to admissive the sell. If your trade isn't successful, you get into't receive a payout. This means you forfeited your capital, but nada else, because your risk is capped.

What's the difference between options and positional notation options?

Binary options are short circuit-term, limited risk contracts with two possible outcomes at exhalation – you either make a predefined profit or you lose the money you paid to overt the trade. The reward is fixed on either pull of the strike price. Options, also named vanilla options, have a payout that is parasitical along the divergence of the expunge monetary value of the option and the price of the underlying plus on one pull of the strike price while fixed on the unusual. Options can be interlacing, difficult to price, and have the potential for outsize profits or losings.

What's the minimum deposit for a positional notation options deal out?

At Nadex, you can capable a live accounting for unhampered - that's right, No negligible wedge required. Binary trades at Nadex are priced 'tween $0 and $100, excluding exchange fees. The cost to place a trade is always equidistant to the maximum risk, advantageous any craft fees, which is requisite to be in your account when the order is placed. Not ready for a live account? You can practice trading positional representation system options for at large with our binary options demo describe.

nadex binary options minimum deposit

Source: https://www.nadex.com/learning/how-to-trade-binary-options/

Posted by: espadatheady.blogspot.com

0 Response to "nadex binary options minimum deposit"

Post a Comment