Average Pips Per Day Forex

Introduction

Forex is the near liquid and volatile market in the globe. The average pip move in the major currency pairs is around 100 pips. However, every bit a retail trader, information technology is not impractical to take hold of 100 pips every unmarried day. Though in that location are some strategies out there, information technology is very challenging to make 100 pips per day every solar day. But, there is 20 pips strategy, 30 pips strategy as well every bit fifty pips strategy, which is much reliable than the 100 pips strategy. Then, in this lesson, nosotros shall be discussing the twenty pips strategy.

The xx Pips Strategy

The strategy is very simple and straightforward. Co-ordinate to this strategy, when the price breaks above a range in a logical expanse, you must become long, and when it breaks below a range in a logical surface area, you must go curt. And so, this strategy is basically a breakout strategy. However, it's not as straightforward as it sounds. There are some criteria one must consider before trading this strategy.

❁ Considerations

✓ Currency Pair

You can trade this strategy on any currency pair. However, it is recommended to focus mainly on major and pocket-size currency pairs.

✓ Session

Though the market place is open up 24 hours, it does not hateful you can utilize this strategy whatsoever time during the day. To proceed it safe, it is advised to trade only during the times when in that location is high liquidity. That is, the London – New York overlap would be the best time to apply this strategy. Else, the London session or the New York session will work perfectly fine as well. And information technology is great if yous do not trade it during the Asian session, equally markets don't ordinarily break out during this period.

✓ Timeframe

Timeframe plays an of import role when it comes to trading a strategy of this blazon. To make xx pips a day, it is platonic to stay between the 1hour timeframe and the 15-infinitesimal timeframe.

✓ Indicators

This strategy does not require whatsoever technical indicators.

❁ How to merchandise the xx pips strategy

Below is a pace past stride procedure to trade this strategy.

- Open the candlestick chart of any currency pair, preferably, a major or small-scale currency pair.

- Firstly, get to the 1-hour timeframe in the chart and see if the market is in a logical area to buy or sell (Ex: Support and resistance).

- If yes, then wait for the cost to break above or beneath the consolidation expanse.

- Check the strength of the breakout on the lower timeframe (15 minutes). Based on the strength, prepare to hit the purchase or sell.

❁ Trading the xx pips strategy on the live charts

• Purchase example

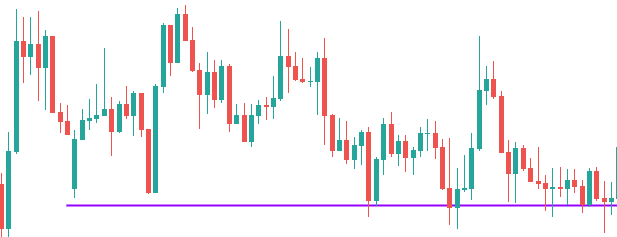

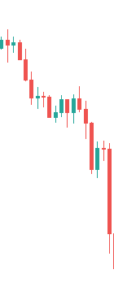

Beneath is the chart of AUDUSD on the ane-hour timeframe. We can see that the market has been bouncing off from the purple line. And then, this becomes a logical area to buy. Now, the market is belongings at the royal support line. And it was in a tiny range for similar x candles. Now, to utilize the strategy, we demand the market to pause above this range.

In the below image, we can see that the market breaks to a higher place the range with a large greenish candle. But, before hitting the buy, nosotros must switch to the lower timeframe and see if the momentum of the candle that broke the range was strong or non.

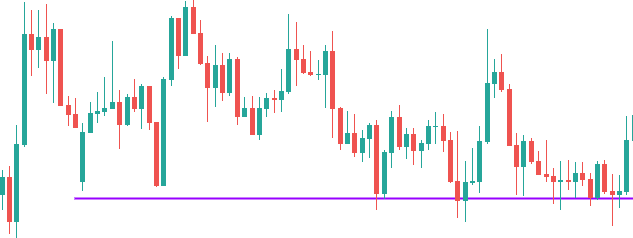

In the below 15 min chart, we tin conspicuously see that the broke above the range in simply 2 dark-green candles. This is an indication that the buyers have come up strong. Hence, now we tin set up to go long.

Coming to the take profit and finish loss, the take profit would, of course, be xx pips, and the stop loss tin be kept a few pips below the back up area. Alternatively, yous can even go for a 1:ane RR by keeping a cease loss of pips.

• Sell case

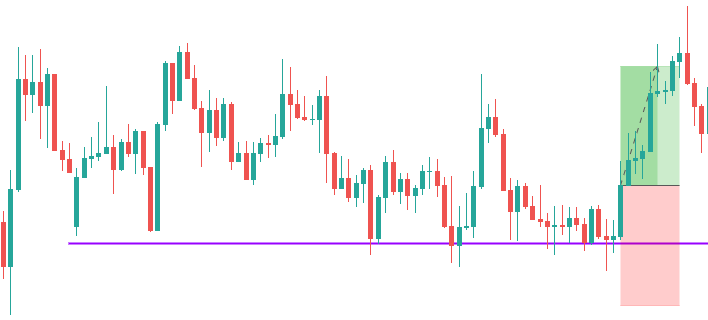

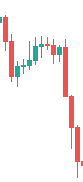

Annotation that this strategy can be practical when the market place is in a trending state besides. Below is the chart of EUR/USD on the i-hr timeframe, and nosotros can see that the market is in a downtrend. The market place keeps making lower lows and lower highs. At nowadays, it can be seen that the market is pulling back, and a greenish candle has appeared. Now, all nosotros need is the price to suspension beneath the pullback to give us a heads up that the downtrend is notwithstanding active.

In the below chart, nosotros can see that, in the very side by side candle, the market broke below the pullback area. Hence, we can prepare to go short after getting confirmation of the strength from the lower timeframe.

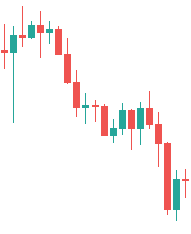

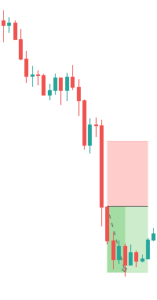

In the beneath 15-infinitesimal timeframe chart, we tin can see that the momentum of the candle was sufficiently robust during the breakout. Hence, we can consider shorting in now.

As far every bit the take turn a profit and terminate loss are concerned, information technology remains the aforementioned every bit the previous instance. That is, twenty pips take profit with 20 pips finish loss.

Bottom line

A great characteristic to consider about this strategy is that it can exist used in whatsoever state of the market. All the same, all the criteria mentioned higher up must be met for the strategy to work. If yous're a beginner in trading, then this could be an ideal strategy to get started with. And if you have experience in trading, y'all can attempt enhancing the strategy by applying some indicators and patterns.

Annotation that this strategy, just like other strategies, does not provide 100% accuracy. There are times when this strategy fails, as well. Hence, it is recommended to employ this strategy in conjunction with other strategies to accept a amend winning probability. Happy Trading!

Source: https://www.forex.academy/heard-of-the-amazing-20-pips-per-day-strategy/

Posted by: espadatheady.blogspot.com

0 Response to "Average Pips Per Day Forex"

Post a Comment